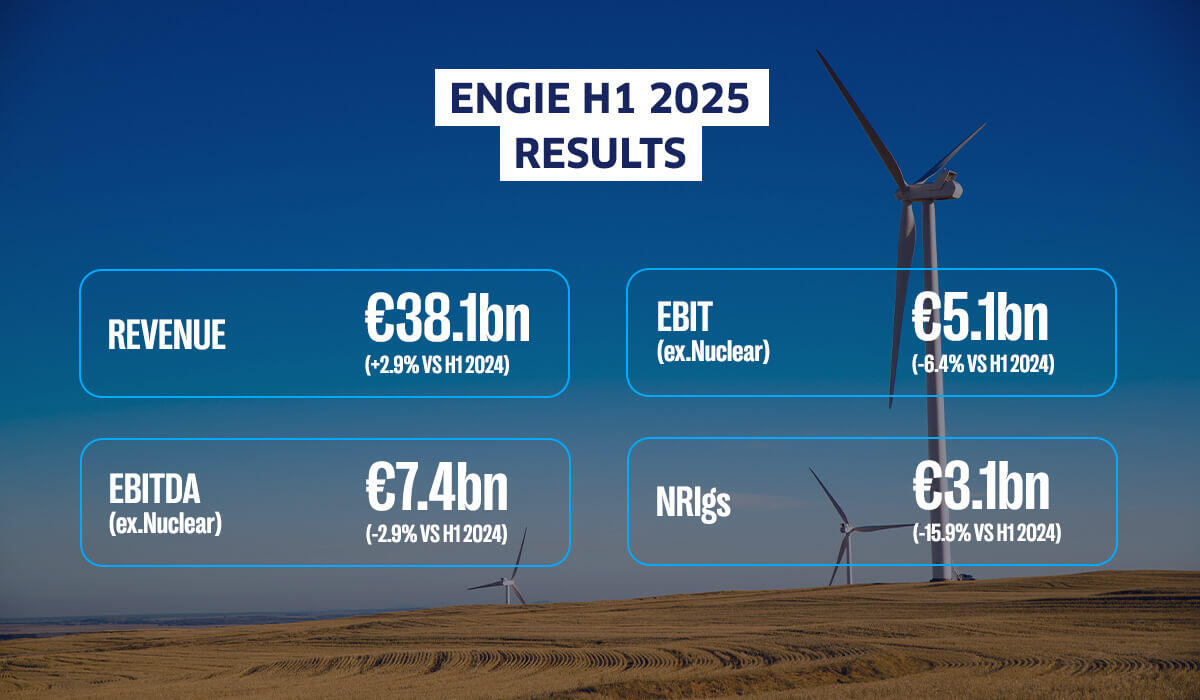

“ENGIE achieved a solid financial performance in the first six months of the year, marked notably by a very high cash flow generation of €8.4 billion. Our operational excellence allowed us to successfully complete large-scale projects on time and within budget. We commissioned the Red Sea Wind Energy park in Egypt, the largest wind farm in the Middle East and Africa, produced the first power from the Yeu-Noirmoutier islands offshore wind farm in France, and restarted the Tihange 3 power plant in July as part of the nuclear LTO signed with the Belgian government. Our diversified geographical footprint is a key asset that provides the necessary flexibility to achieve our goals in the current economic and geopolitical context, and also to contribute to the energy transition in the countries where we operate. We approach the coming months with confidence and confirm our annual guidance. As anticipated, EBIT excluding nuclear is reaching its low point this year, but with H2 2025 expected to be up compared to last year.“

Catherine MacGregor – CEO