During the first half results presentation, Isabelle Kocher, Chief Executive Officer of ENGIE, stated: "The 2016-18 transformation plan announced end February is well on track. Over the first six months of 2016 we have already achieved close to 40% of our portfolio rotation program target. Our Lean 2018 performance plan is delivering according to plan. We have also accelerated our digital transformation with the launch of ENGIE tech, expected to be a new businesses factory for ENGIE, and by signing four key strategic partnerships with Fjord, C3 IoT, Kony et IBM to accompany our “métiers” lines in this digital revolution. Moreover we have pursued the implementation of our strategy towards low CO2 generation with the commissioning of 500 MW of new low carbon-intensive capacities. This transformation is well engaged and I am convinced that it will be a success thanks to the commitment of ENGIE’s 155 000 employees."

Analysis of financial data

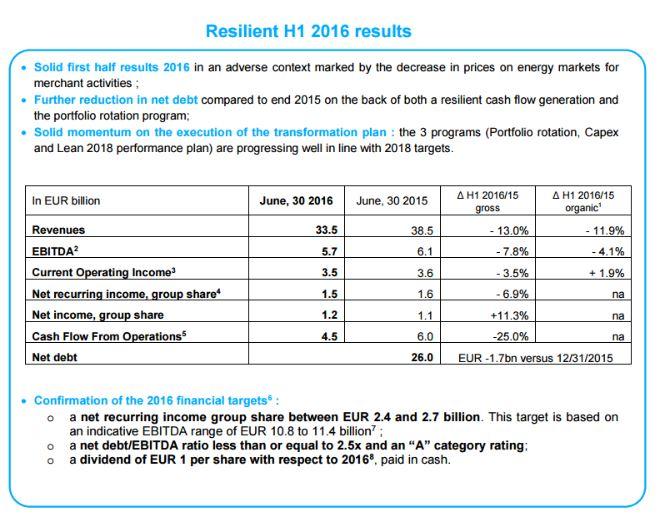

Revenues of EUR 33.5 billion

Revenues fell by 13.0% on a reported basis to EUR 33 504 million and by 11.9% on an organic basis compared with the period ended June 30, 2015. This organic decrease is mainly attributable to lower commodity prices which impacted gas midstream and LNG activities, gas and electricity retail businesses, exploration and production, and power generation businesses.

Ebitda of EUR 5.7 billion

Group Ebitda amounted to EUR 5 651 million, down 7.8% on a reported basis and 4.1% on an organic basis. H1 Ebitda benefited from the positive impact of the restart of the Doel 3, Tihange 2 and Doel 1 nuclear power plants in Belgium end December 2015, the initial effects of the Lean 2018 performance program and the impact of commissioning of new assets. Nevertheless, these positive items were more than offset by the unfavorable exchange rate effect (EUR -176 million, chiefly related to the Brazilian real and the Norwegian krone) and negative price impacts for gas and LNG midstream activities and in a lesser extent for E&P and power generation.

Ebitda for North America, Latin America and Africa/Asia was down due to unfavorable price effects, notably in North America and Brazil where H1 2015 had benefited from particularly high spot prices, positive one-off impacts. These impacts were partially offset by the good performance of our activities in Peru due to improved production volumes and the commissioning of the Quitaracsa hydroelectric power plant, and by the commissioning of the Mayakan gas pipeline extension in Mexico.

Ebitda for Benelux was up sharply as a result of the positive impact of the restart of the Doel 3, Tihange 2 and Doel 1 nuclear power plants at end 2015 and to a lesser extent due to improved retail business margins.

Ebitda for France improved on the back of the growth in renewable power generation business, the rise in electricity volumes sold, and the slight increase in services business margins. These increases together with the impact of the Lean 2018 performance program are partly compensated by a loss in market share on gas supply to business customers.

Ebitda in Europe excluding France and Benelux grew slightly driven by an improved performance from services and retail businesses, and a reduction in G&A partly offset by the adverse impact of new gas distribution tariffs in Romania.

Ebitda for Infrastructures Europe segment remained stable, the positive effects from 2015 annual tariff revisions for Transmission and Distribution are compensated by lower volumes sold at a lower average price at Storengy (low summer/winter spreads vs. 2015).

Ebitda for the GEM & LNG segment declined due to the positive impact in first-half 2015 of revised gas supply conditions, and the sharp fall in LNG trading margins, particularly with shipments from Yemen halted as from April 2015.

Ebitda for Exploration & Production activities was down due to the fall in the market prices of oil and gas, partially offset by the slight increase in production (30.0 Mboe compared to 29.0 Mboe).

Ebitda for the segment Other was down due to the positive impact of one-off items recorded in first-half 2015 and the slight contraction in engineering activities. These factors were partially offset by an improved performance from thermal power generation activities in Europe.

Current operating Income of EUR 3.5 billion

Current operating income amounted to EUR 3.5 billion, down 3,5% on a reported basis and up 1.9% on an organic basis compared with first-half 2015. The organic decrease recorded at Ebitda level is mainly compensated by the positive impact from the reduction of depreciation and amortization charges as a result of the impairment losses recorded at end 2015 and the impact of reclassifying the portfolio of merchant power generation assets in the US as assets held for sale.

Net recurring income of EUR 1.5 billion and net income of EUR 1.2 billion

Net recurring income Group share amounted to EUR 1.5 billion, down EUR 0.1 billion compared to first-half 2015. The decline in current operating income after share in net income of entities accounted for using the equity method was partly offset by the improvement of the recurring financial result.

Net income Group share amounted to EUR 1.2 billion for the six months ended June 30, 2016, up EUR 0.1 billion compared to first half 2015. The result was boosted by the partial disposal of Transmisora Eléctrica del Norte (TEN) in Chile and by the positive evolution in the fair value of hedging contracts related to electricity and gas purchases and sales, as well as the improvement of the recurring financial result and lower impairment losses compared to 2015.

Net debt at EUR 26 billion

Net debt stood at €26.0 billion at June 30, 2016, down EUR 1.7 billion compared with net debt at end 2015. This improvement mainly reflects the following items: cash generated from operations in H1; the initial effects of the portfolio rotation program (EUR 1.8 billion, particularly the disposal of the merchant hydro generation asset portfolio in the United States, the reclassification of thermal power generation assets in India as assets held for sale, and the partnership established as part of the TEN project which led to the disposal of 50% of the holding in TEN in Chile); and a favorable exchange rate effect (EUR 0.3 billion). These items were partially offset by investments in the period (EUR 3.1 billion), dividends paid to ENGIE SA shareholders (EUR 1.2 billion) and to non-controlling interests (EUR 0.2 billion), cash outflows related to tax payments (EUR 0.8 billion) and interest payments on net debt (EUR 0.4 billion).

Cash Flow From Operations amounted to EUR 4.5 billion down EUR 1.5 billion versus last year. This decrease reflects both a resilient operational cash flow generation and unfavorable year-on-year changes in working capital requirements (EUR -1.1 billion), mainly due temporary impacts related to margin calls and financial derivatives.

The net debt to EBITDA ratio came out at 2.41 at June 30, 2016, in line with the target of a ratio less than or equal to 2.5x. The average cost of gross debt slightly declines compared to end 2015 at 2.8%.

At end June 2016, the Group posted a high level of liquidity of EUR 16.0 billion, of which EUR 8.8 billion was held in cash.

End April 2016, S&P downgraded ENGIE’s long term credit rating to A- from A with negative outlook while Moody’s downgraded ENGIE’s long term credit rating to A2 from A1 with stable outlook.

Transformation plan well advanced in line with 2018 targets

The 2016-2018 transformation plan announced end February and confirmed at our Investor Day progresses well, in line with our 2018 targets.

On our portfolio rotation program (EUR 15 billion net debt impact targeted over 2016-18) we have announced to date EUR 5.8 billion of disposals (i.e. 40% of total program), of which EUR 1.8 billion already booked at end June 2016.

On our capex program (EUR 15 billion growth capex over 2016-18), around EUR 11 billion are already committed, of which EUR 2.1 billion have been invested at end June 2016.

As regards Lean 2018 performance plan (EUR 1 billion savings targeted by 2018), we have made significant progress with more than EUR 0.2 billion of net gains recorded at Ebitda level at end June 2016, which is in line with our annual target (EUR 500 million) and three year objective of EUR 1 billion.

Finally, on the front of innovation and digital transformation we have been very active already in H1 to prepare the future. The acquisition of OpTerra and the purchase of a majority stake in Green Charge Networks have reinforced our position in energy services and battery storage. Our recent commercial successes, notably in Senegal for the conception-realization of the railway systems of the future express train in Dakar, underline both our ability to provide innovative integrated solutions and multi-service offers to our clients.

Significant events

Implementation of the strategy

- 4 projects won in solar: 140 MW and 75 MW in India, 40 MW in Peru and 23 MW in Mexico

- In France, acquisition of 100% of MAÏA EOLIS which reinforces ENGIE’s leadership position in wind

- In Panama, signing of a contract to supply LNG to AES power plant

- In the Paris region, inauguration by Compagnie Parisienne de Chauffage Urbain (CPCU) of the conversion of a biomass boiler plant in Saint-Ouen

- In the United States, closing of the OpTerra acquisition, which reinforces ENGIE’s offer in innovative and differentiating energy services

- In South Africa, start of the construction of Kathu 100MW solar project

Pave the way for the future

- Signing of a memorandum of understanding with SUSI Partners to finance grid-scale energy storage projects

- Investment in StreetLight Data, an industry-leading mobility analytics company to accelerate the development of smart cities

- Green mobility in Europe: up to EUR 100 million of investments to promote natural gas as a fuel for trucks in Europe by 2020. Through wholly owned subsidiaries GNVert and LNGeneration, ENGIE is contributing to the development of a new “green gas” sector: Bio-LNG (Liquefied Biomethane), which can be used both to power vehicles and to generate electricity. La Poste and ENGIE partner to develop green mobility in France and Europe using alternative fuels VNG/bioVNG and hydrogen

- Social innovation: signing of an ambitious European social agreement to support the implementation of the enterprise project

- ENGIE reinforces its international investment fund for promoting access to energy, “ENGIE Rassembleurs d’Energies”, increased to EUR 50 million

- In Belgium, the port of Antwerp has awarded to ENGIE a 30-year concession agreement for the construction and operation of sustainable infrastructure powered by LNG, CNG and electricity for inland navigation and road transport

- ENGIE acquires a 80% stake in Green Charge Networks, an industry-leading battery storage company based in California

- ENGIE signed four new Terr’Innove agreements with locally elected officials committed to the energy transition, bringing the number of such partnerships to 32 in France

- ENGIE creates its Digital Factory and announces global partnerships with C3 IoT, Kony and chooses Fjord, Accenture's design and innovation studio, to reinvent its commercialization model

- ENGIE joins forces with IBM to deploy smarter cities solutions and improve the quality of life for citizens

- ENGIE opens in Singapore a new R&D centre of excellence focused on green-energy

- ENGIE and Thales selected for a EUR 225 millions rail systems contract in Dakar, Senegal

In response to profound changes in the energy sector and the growing importance of environmental and societal factors to its stakeholders, ENGIE announces at the beginning of May six new non-financial objectives to be achieved by 2020:

- A customer satisfaction score of 85% among its B2C customers;

- A production portfolio containing 25% renewable energy (9) ;

- A 20% reduction in the ratio of CO2 emissions for each source of energy production, as compared with 2012 (10). This objective augments ENGIE’s previous objective and is a result of the Group’s decision, in October 2015, to concentrate solely on low-carbon projects using renewable energy and natural gas, and no longer to launch new coal-based projects;

- 100% coverage of the Group’s activities by an appropriate mechanism for dialogue and consultation with its stakeholders, based on regular meetings with NGOs and non-profits alongside long-term partnerships related to the Group’s activities;

- A workforce comprising 25% women (11) ;

- A work-related accident frequency rate of less than 3 (12).

UPCOMING EVENTS

- October, 14 2016: 2016 interim dividend of EUR 0.5 per share to be paid for fiscal year 2016. Ex-dividend date is October, 12 2016

- November, 10 2016: Publication of results as of September 30, 2016 before market opening

The presentation of H1 results and the half year financial report, including the management report, consolidated financial statements and notes, are available on our website.