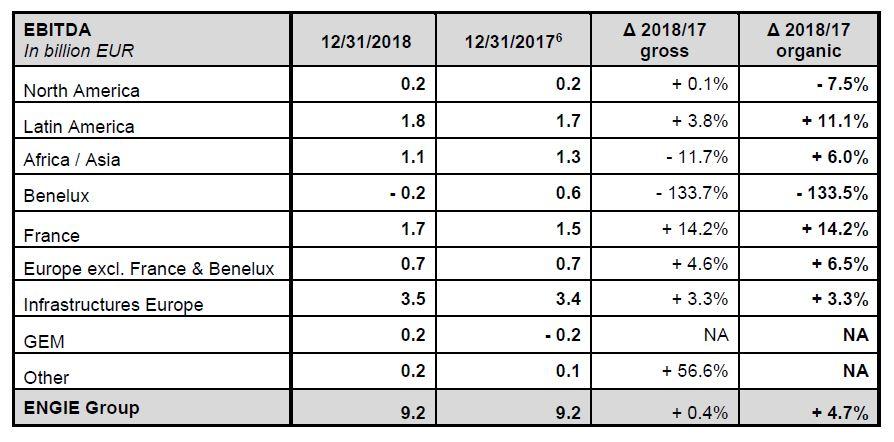

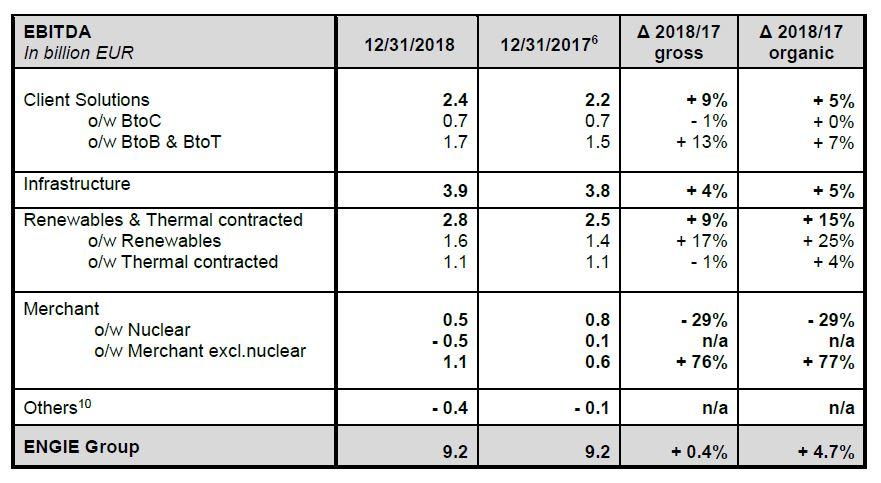

Apart from Nuclear, all activities delivered reported and organic growth, despite a significant adverse foreign exchange effect.

- In Client Solutions, 9% reported EBITDA growth was driven by a strong overall performance in BtoB and BtoT Solutions and a stable performance in B2C. BtoB and BtoT Solutions delivered 13% reported EBITDA growth, driven mainly by contributions from new acquisitions, good services volume and margin performance in Europe, and from gas and electricity sales to businesses in Europe and Latin America. B2C was stable compared with 2017, with a decrease in gas volumes and margins in France offset by an increase in the electricity client portfolio in France and Australia and by positive one-offs in Europe.

- Infrastructure delivered 5% organic EBITDA growth despite an unfavorable temperature effect in France. Growth was driven primarily by the implementation of the French gas storage regulation on January 1, 2018, Mexican gas transportation tariff increases and gas distribution activities in Argentina and Thailand. These positive impacts were partly offset by the introduction of new contractual provisions in gas transportation business for low calorific gas conversion in the north of France.

- Renewables and Thermal contracted delivered 9% reported EBITDA growth and a strong 15% organic growth. The negative impact of the depreciation of the Brazilian real and, to a lesser extent, of the US dollar against the euro was partly offset by the contribution of the two hydro concessions in Brazil acquired at the end of 2017. Renewable power generation delivered strong 25% organic growth, driven primarily by a large number of wind and solar farm partial disposals in 2018 (DBpSO (11) model) and by growth in hydro power generation in France. Thermal Contracted power delivered 4% organic growth even though there were more significant positive one-offs in 2017 than in 2018. Growth was driven by new long-term PPAs obtained in Chile and the commissioning of the Safi power plant in Morocco, which more than offset the expiration of long-term PPAs in Peru.

- The Nuclear business reported a very significant decrease due to unscheduled outages leading to a very low availability rate of 52% in 2018 and due to a decrease in captured prices.

- Merchant business excluding Nuclear delivered very strong 76% growth in reported EBITDA and 77% organically, driven mainly by a good performance from Global Energy Management (GEM) and thermal power generation in Europe.

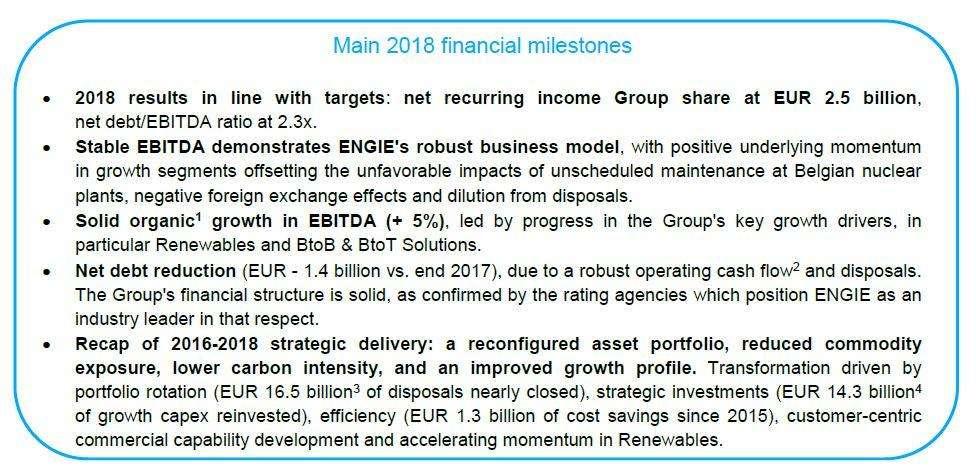

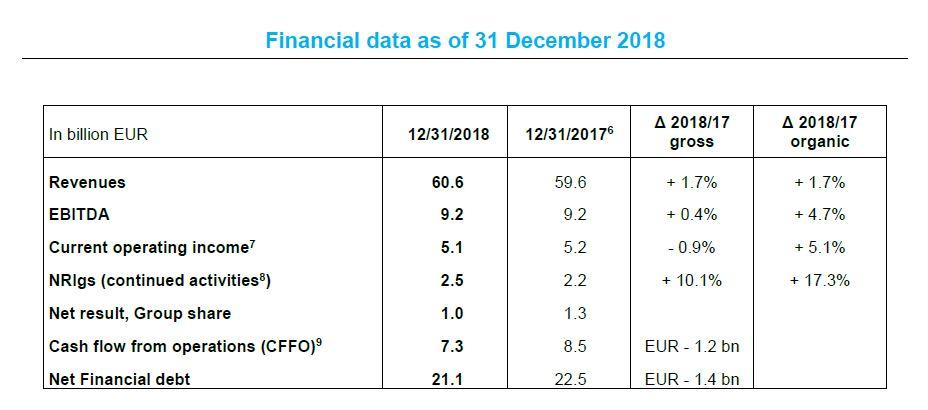

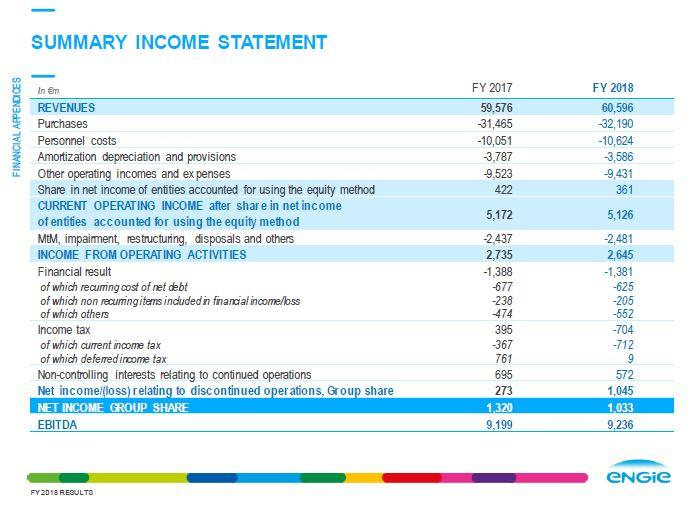

Current operating income (5) of EUR 5.1 billion

Current operating income including share of net income of entities accounted for using the equity method amounted to EUR 5.1 billion, down 0.9% on a reported basis and up 5.1% on an organic basis compared with 2017, in line with EBITDA growth.

Net recurring income, Group share on continued activities of EUR 2.5 billion (8)

Net income, Group share of EUR 1.0 billion

Net recurring income, Group share relating to continued activities amounted to EUR 2.46 billion in 2018, a sharp increase of 10.1% compared with the previous year, driven by the continued improvement in current operating income after share in net income of entities accounted for using the equity method, coupled with an improvement in the recurring effective tax rate.

Total net income Group share (12) amounted to EUR 1.0 billion compared with EUR 1.3 billion in 2017. It includes mainly impairment losses, partially offset by the gain on disposal of the upstream LNG business (“Discontinued operations”).

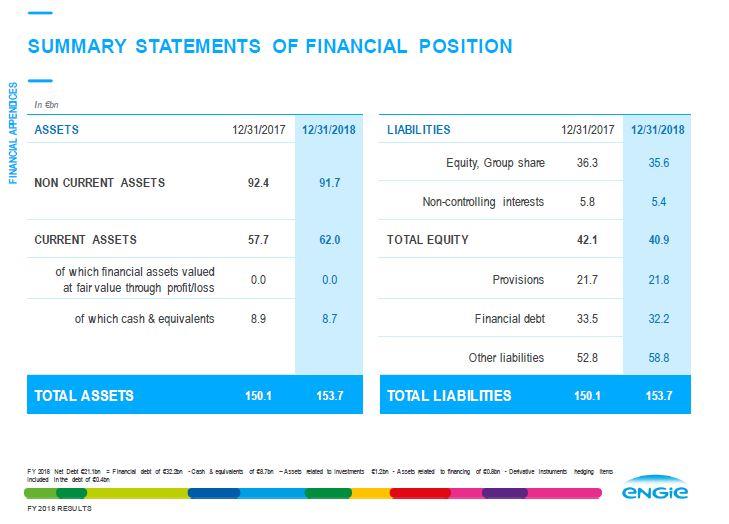

Net financial debt at EUR 21.1 billion

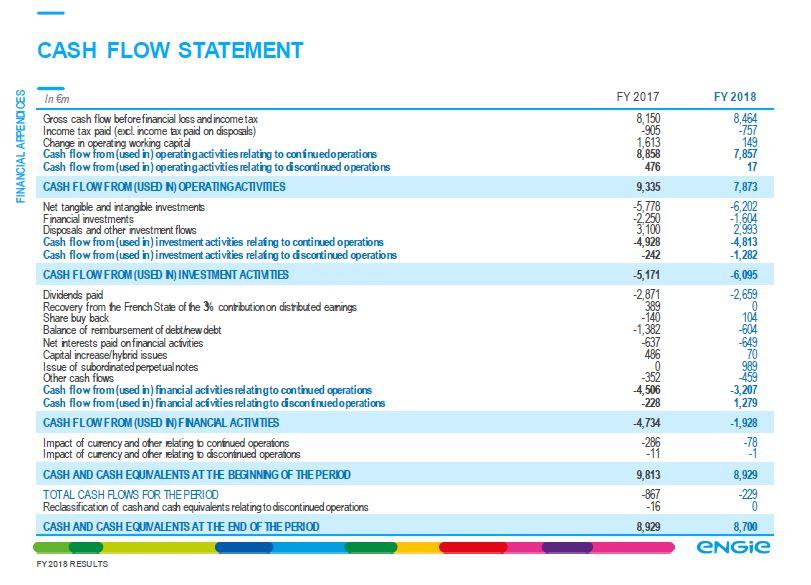

Net financial debt stood at EUR 21.1 billion, down EUR 1.4 billion compared with December 31, 2017. This variation is mainly due to (i) cash flow from operations (EUR 7.3 billion), (ii) the impacts of the portfolio rotation program (EUR 4.4 billion, including the closing of sale of the Exploration-Production and upstream LNG businesses, the Loy Yang B coal-fired power plant in Australia and the distribution business in Hungary, as well as the classification of Glow, a power plant operator in the Asia-Pacific region, as "Assets classified as held for sale"). These items were partially offset by (i) gross capital expenditure over the period (EUR 7.6 billion (13)), and (ii) dividends paid to ENGIE SA shareholders (EUR 1.7 billion) and to non-controlling interests (EUR 0.6 billion).

Cash flow from operations (CFFO) amounted to EUR 7.3 billion, down EUR 1.2 billion compared with 2017. The decrease stems chiefly from the return to a normal level of working capital (EUR 1.5 billion negative impact) and from a decrease in financial cash flows, partly offset by an increase in operating cash flow and lower tax expense.

At end December 2018, net financial debt to EBIDTA ratio amounted to 2.3x, below the target of less than or equal to 2.5x. The average cost of gross debt was 2.68%, up very slightly compared with 2017.

Economic net debt (14) to EBITDA ratio stood at 3.85x, stable compared with end 2017. Taking into account the future impact of IFRS 16 at EBITDA level, the ratio stands at 3,66x.

Successful strategic repositioning for ENGIE

ENGIE successfully continued its strategic repositioning and reached the targets set in 2016:

- The disposal of its interest in Glow in Asia-Pacific (announced in June 2018) will reduce ENGIE's consolidated net debt by EUR 3.2 billion. It will enable the Group to complete its portfolio rotation program initiated three years ago. To date, EUR 16.5 billion (3) of disposals were announced, of which EUR 14.0 billion already booked.

- The capital expenditure program has also been completed, with EUR 14.3 billion (4) of growth investments since 2016, mainly in Renewables and Thermal contracted (48%), but also in Client Solutions (33%) and Infrastructure (15%).

- The Lean 2018 performance program achieved EUR 1.3 billion in net gains at EBITDA level at the end of 2018, versus an initial cost reduction target of EUR 1.0 billion.

In addition, this successful strategic repositioning also led to an improvement in the Group's capital efficiency and profitability, with in particular an increase in ROCEp (16) of more than 90 bps over the period 2016-18 and an increase in Client Solutions COI margins of 30bps in 2018.

2019 financial targets

ENGIE anticipates for 2019 a net recurring income, Group share between EUR 2.5 and EUR 2.7 billion. This guidance is based on an indicative range for EBITDA of EUR 9.9 to 10.3 billion, after IFRS 16 leases (17) implementation.

For 2019, ENGIE anticipates:

- a net financial debt/EBITDA ratio below or equal to 2.5x, and

- an ‘A’ category credit rating (18).

In order to monitor and communicate performance of this objective, segment information will be complemented from 2019 onwards. In accordance with the project, the internal organization will need to be adapted, which will be announced shortly.

Dividend policy

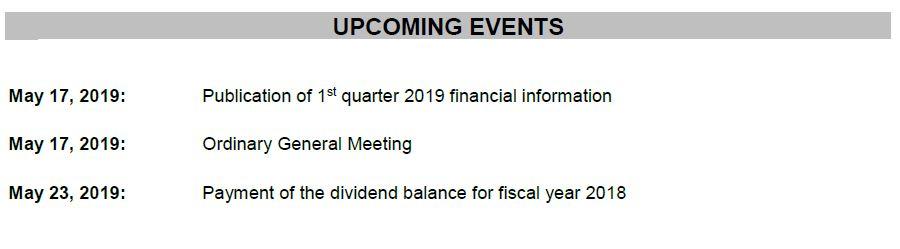

For fiscal year 2018, ENGIE confirms the payment of a EUR 0.75 per share dividend, payable in cash.

From 2020 (19), the annual dividend will be paid in one time, at the end of the Ordinary General Meeting (OGM) approving the annual accounts.

In order to offset the impact of this transition on shareholders in 2019, ENGIE will submit for shareholder approval at its OGM on May 17, an exceptional dividend of €0.37 per share, which will bring the total distribution decided by this General Meeting to €1.12 per share.

Looking ahead, ENGIE announces a new medium-term dividend policy, in the range of 65 to 75% NRIgs payout ratio. For the fiscal year 2019, ENGIE is aiming for a dividend at the upper end of this range.

Significant operational milestones since January 2018

Renewables and Thermal contracted power activities

In France, the Group confirmed its N°1 position in solar and wind power by winning 230 MW in the latest governmental call for tenders and by acquiring a portfolio of 1.8 GW of projects (acquisition of LANGA, 1.3 GW; acquisition of SAMEOLE, 500 MW). In addition, FEIH company (jointly owned by ENGIE and Crédit Agricole Assurances), reached 1.5 GW of solar and wind installed power capacity by the beginning of 2019.

In the United States, ENGIE acquired Infinity Renewables and hence became a leader in the development of wind farms. The company has already developed 1.6 GW of capacity and has a portfolio of 8 GW of projects at various stages of development. In India, the Group opened the Mirzapur solar farm and reached 1 GW of renewable capacities (solar and wind, installed or in construction) by winning a new 200 MW wind project. In Spain, the Group is developing, together with partners, 9 wind farms for a total capacity of 300 MW. In Senegal, ENGIE has been attributed the development of 2 solar parks for a total capacity of 60 MW.

ENGIE has mobilized its expertise to provide customers with complex renewable solutions, either through specific technology or tailor-made solutions. In offshore wind power in France, two ENGIE projects (Le Tréport and Yeu-Noirmoutier islands) were confirmed in July 2018 by the President of the Republic; the first authorizations were obtained in October for the Yeu and Noirmoutier islands project.

In early 2019, ENGIE commissioned the Kathu thermodynamic solar power plant, one of South Africa's largest renewable energy projects. This thermodynamic concentrated solar power plant (CSP) has a capacity of 100 MW and allows, via a molten salt storage system, to store 4.5 hours of autonomy.

The Group announced it will develop small-scale solar power plants, partnering with SUEZ to install photovoltaic solar parks on each of its waste storage and recycling facilities in France for a total estimated capacity of 1 GW, and partnering with GreenYellow to address areas such as roofs and parking lots. In addition, in Norway, ENGIE has signed the financial agreements for a 208 MW wind farm project whose energy will be sold to the aluminium manufacturer Hydro under the terms of a 25-year contract.

In Mexico and in Chile, the Group developed its BtoB green electricity offer and signed a 15-year power purchase agreement (PPA) with steel producer Gerdau. The electricity thus delivered will come from new supply contracts backed by a 130 MW photovoltaic power plant.

Finally, ENGIE is completing the sale of its entire stake in Glow in Asia-Pacific, and thus will cease its coal-fired power plant operations in the region.

Infrastructure activities

In France, in Dunkirk, the Group inaugurated the first pilot to inject green hydrogen to the gas distribution network (GRHYD project), and announced that it will mobilize EUR 800 million over the next five years to develop green gases.

In Brazil, the Group signed the concession contract for the Gralha Azul electric transmission line.

Client Solutions

ENGIE has strengthened its positioning in Client Solutions in several regions.

In Europe, ENGIE is increasing its leadership in airport services with the acquisition of Priora FM SA, a company specialising in building, infrastructure and facility management. In Germany, the Group confirmed its position as a leader in technical services for buildings with the acquisition of OTTO Luft-und-Klimatechnik in early 2019. The Group also continued to develop its nuclear maintenance business with the acquisition by its subsidiary ENDEL of SUEZ's specialised subsidiary, ex-SRA SAVAC.

In the United States, ENGIE acquired Unity International, an electrical engineering installation company based in New York City. In Latin America, ENGIE is expanding its service offering with the acquisition of CAM (Compañía Americana de Multiservicios), a leader in installation, operation and maintenance services in the electricity and telecommunication sectors.

During 2018, ENGIE also continued its investments in innovative decentralized technologies, with the acquisition of Electro Power Systems, now ENGIE EPS, a pioneer in hybrid storage solutions and micro-grids, and of SoCore in the United States, which offers integrated solar solutions to cities, local authorities and businesses.

The Group also won landmark contracts with cities and local authorities. In France, ENGIE will create a 3D data and modelling platform for the Île-de-France region called "Smart Platform 2030". In Australia, the Group signed a partnership with Greater Springfield to make it one of the first positive energy cities in the country. In Romania, ENGIE acquired Flashnet, an IoT company specialising in intelligent public lighting.

In green mobility, ENGIE has inaugurated in France the largest hydrogen utility fleet and the first alternative multi-fuel station. It has also partnered with Arval to launch in Europe a new green electric mobility offer in which ENGIE will install and maintain charging points. In early 2019, in Chile, the Group signed a contract to supply an initial phase of 100 electric buses to the city of Santiago.

In the Campus & Universities market, ENGIE won a major contract in the UK for the renovation and management of buildings at the University of Kingston in London. Besides, in the U.S., to serve the Longwood Medical Campus in Boston, the Group acquired a micro-grid for electricity, heat and cooling.

In order to provide solutions adapted to the needs of retail consumers, ENGIE has enriched its solar self-consumption offer in France with a modular solution of batteries that can be combined with photovoltaic panels, and launched its 1 euro efficient gas boiler offer dedicated to under privileged households. Besides, the Group also invested in HomeBiogas, an Israeli start-up that has developed a digester that allows individuals, in various countries, to transform their organic waste into green cooking gas and liquid fertilizer.

Other Group events

- January 10, 2018: ENGIE sets new hybrid bond record with the lowest coupon ever achieved by a Corporate. ENGIE took advantage of the attractive market conditions to place its first Green Hybrid Bond (Deeply Subordinated Perpetual Bond) of an amount of EUR 1 billion. The total amount of bonds issued by ENGIE in Green Bond format since 2014 reaches EUR 6.25 billion, confirming ENGIE’s commitment to play a leading role in the energy transition whilst supporting the development of green finance.

- May 18, 2018: Following the General Shareholders’ Meeting which marked the end of Gérard Mestrallet’s term as Chairman of the Board and the designation of Jean-Pierre Clamadieu as an independent administrator, the ENGIE Board met and unanimously appointed Jean-Pierre Clamadieu as new Chairman. The Board also appointed Gérard Mestrallet as Chairman of Honour of the Group, acknowledging the whole of his action. In addition, the Board registered the resignation of Stéphane Pallez. Ross McInnes, appointed as an independent administrator by the General Shareholders’ Meeting, joins the Audit Committee. Christophe Agogué, who succeeds Olivier Marquer whose term as employee administrator for the “engineers, managers and equivalent college” expired, is appointed as member of the Ethics, Environment and Sustainable Development Committee. The Board of Directors is now composed of 19 members, including 9 independents, 8 women and 5 different nationalities.

- May 18, 2018: In France, ENGIE acknowledges the Conseil d’Etat’s decision, announced on May 18, 2018, ruling that regulated tariffs for the sale of electricity do not comply with the European law, due to the absence of a mechanism allowing for a periodic re-examination of the tariffs in addition to their overly broad application engulfing private and professional customers. ENGIE welcomes this beneficial decision for professional clients who will have a real choice through more competitive prices. ENGIE nonetheless regrets the Conseil d’Etat’s analysis which diverges from its viewpoint dating back to July 19, 2017 when it considered, for different reasons, that the pursuit of regulated tariffs for natural gas did not comply with the European Law, after having called upon the European Union’s Court of Justice. The Group considers that the pursuit of regulated tariffs for the sale of electricity to private customers would prolong a deep distortion of competition which exists on the energy markets, where the same actors are active, excessively reinforcing the dominant position of France’s historical electricity operator.

- June 20, 2018: ENGIE takes note of the European Commission’s decision issued on June 20, 2018, against Luxembourg. The latter relates to two tax rulings dated 2008 and 2010 regarding the tax treatment of the financing operations of the Group’s activities in Luxembourg. ENGIE has fully complied with the applicable tax legislation and considers that it has not benefited from a State aid. In addition, ENGIE was transparent by requesting, from the Luxembourg authorities, a ruling confirming its correct interpretation of Luxembourg law. ENGIE will assert all its rights to challenge the State aid classification considering that the Commission did not demonstrate that a selective tax advantage was granted. Therefore, ENGIE will apply for annulment of this Commission’s decision before the relevant courts.

- July 06, 2018: In order to coordinate the performance efforts of ENGIE’s operational entities, Paulo Almirante becomes Chief Operating Officer (COO) of the Group. With strong and acknowledged industrial expertise and international experience, he will support the action of the members of the Executive Committee in relation to the current performance and development programs. He remains Executive Vice President, in charge of the Generation Europe, Brazil, NECST (North, South and Eastern Europe), MESCAT (Middle East, South and Central Asia and Turkey) Business Units, and of Environmental and Social Responsibility.

- July 13, 2018: ENGIE, in partnership with Nexity, plans to create its future campus in an exemplary eco-district near Paris. ENGIE and Nexity have concluded a financial and technological partnership to acquire and together develop an exemplary eco-district, a 9-hectares plot of industrial land at La Garenne-Colombes, in the Hauts-de-Seine department (92) in France. The two groups will pool their respective expertise in sustainable cities and energy transition in order to develop this general interest urban project, in close collaboration with the municipality and the public stakeholders. For ENGIE, in compliance with the prerogatives of the representative bodies of the staff concerned, this would mean creating, by 2022-2023, a bespoke campus of more than 120,000 m², conceived according to the highest standards for quality of life at work, thereby bringing together the Île-de-France teams in one place, promoting cooperation, cross-disciplinarity and openness.

- August 3, 2018: Results of the ‘Link 2018’ plan: ENGIE reaches 4% employee shareholding with 40,000 new subscriptions. Launched by ENGIE on 15 February 2018 and concluded on 2 August, the Link 2018 employee shareholding plan enabled more than 40,000 Group employees in 18 countries to take part, with a total amount of 340 million euros in subscriptions, representing 33 million shares. This is the first employee shareholding operation since the strategic shift made by ENGIE in 2016 aimed at refocusing the Group on growth businesses, a move whose realisation is the result of the commitment of its employees. The number of subscribers increased by more than 25% compared to the previous initiative, Link 2014, demonstrating employees' confidence in the transformation plan. The Group is thus allowing its employees to contribute in a different way to its transformation, by acquiring shares in the company on preferential terms.

- September 18, 2018 : ENGIE, the leading utility of the Dow Jones Sustainability Index World. ENGIE’s CSR performance has once again been recognised by the extra-financial rating agency RobecoSAM which has confirmed the Group’s membership of the Dow Jones Sustainability Index (DJSI) World and Europe indices in 2018. The 2018 assessment places the Group as “industry leader” in its sector (Multi and Water Utilities) with a score of 82 out of 100. Companies included in the DJSI are recommended for sustainable investment by RobecoSAM, whose rating is considered the most renowned among experts (including NGOs, public administrations, universities, businesses, media) and as the most credible, after the CDP (formerly the Carbon Disclosure Project).

- December 11, 2018 : ENGIE confirms its intention to remain SUEZ's reference shareholder and is ready to strengthen industrial and commercial cooperation between the two groups. The ENGIE Board of Directors confirms its willingness to actively support SUEZ's development by maintaining its current level of participation.

- January 18, 2019: On January 17, ENGIE issued its first corporate hybrid green bond of 2019, for an amount of €1 billion. With a total of €7.25 billion of green bonds issued since 2014, ENGIE strengthens its position amongst the biggest issuers of corporate green bonds. As a leader in the energy transition, ENGIE has made it a priority to support the development of sustainable finance, notably the green bond market.

*************************************

The 2018 results presentation, used during the investor conference, is available to download from ENGIE’s website: https://www.engie.com/en/financial-results-2018

The Group’s consolidated accounts and the parent company financial statements for ENGIE SA as of December 31, 2018 were approved by the Board of Directors on February 27, 2019. ENGIE’s statutory auditors have performed their audit of these accounts. The relevant audit report is currently being issued.

The complete notice of the Annual General Meeting, draft resolutions and Board of Directors’ report will be published in the second half of March.