What does ENGIE’s individual shareholder base look like?

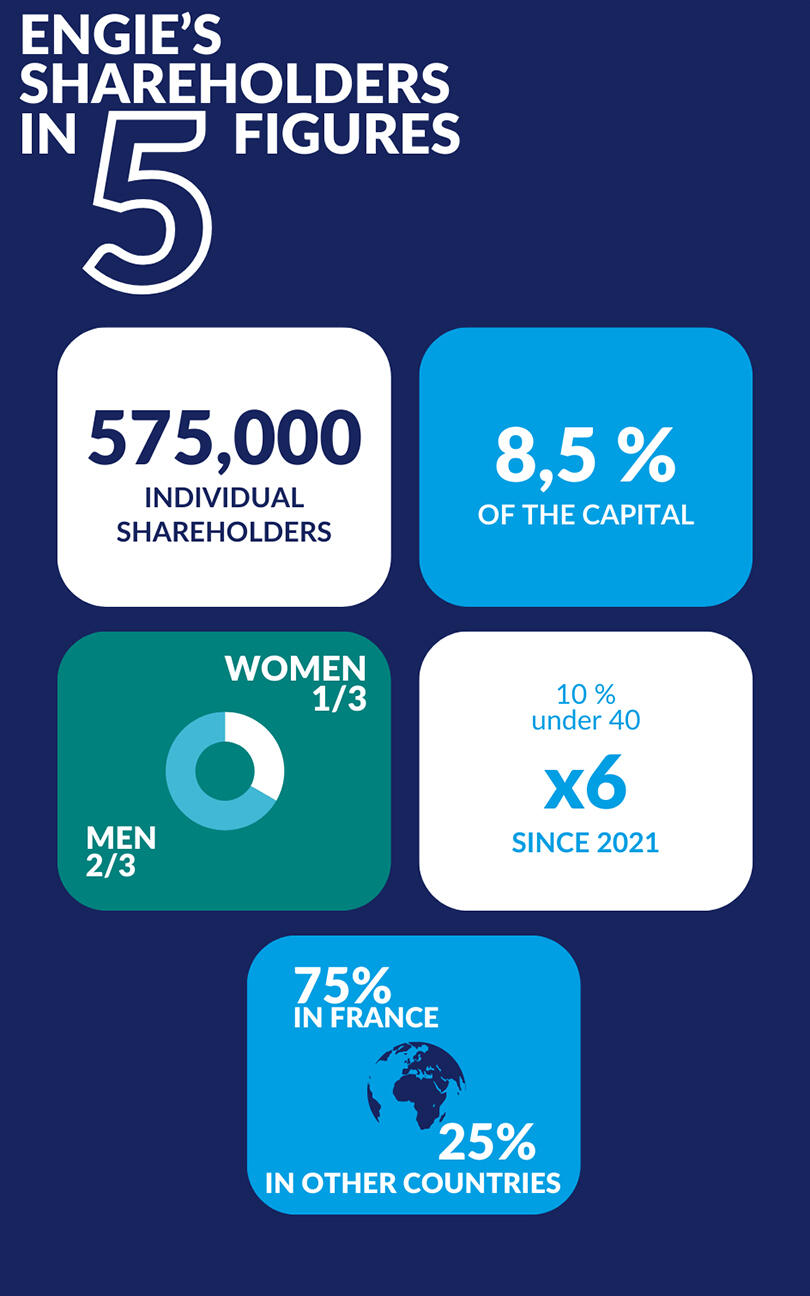

ENGIE has around 575,000 individual shareholders, who hold approximately 8.5% of the capital. In addition, employees hold about 4% of the Group’s capital.

It is one of the French companies with the largest number of retail shareholders.

Today, the typical individual shareholder is mostly male, with an average age of 63. However, things are changing, as investment topics are attracting a broader audience. Between 2021 and 2024, the number of ENGIE shareholders under 40 increased sixfold. Today, they represent nearly 10% of our retail shareholder base. This demonstrates a gradual renewal supported by our efforts to explain the Group’s successful transformation and the attractiveness of ENGIE’s share price.

More broadly, how is equity ownership doing in France?

After several lukewarm years, individual share ownership is experiencing renewed interest in France, as demonstrated by the increase in the number of new investors — at its highest level in 4 years, according to the French Financial Markets Authority (AMF).

What about women investors?

Women are often less optimistic than men regarding the return on their savings, and fewer of them invest in non-guaranteed financial products. They show less interest in equities, which they consider riskier more often than men. This is documented by the AMF’s Retail Investor and Savings Barometer.

What measures is ENGIE using to increase the proportion of women shareholders?

As in many other companies, women are under-represented among ENGIE’s individual investors. We created a group of women investors from diverse backgrounds and ages to reflect on obstacles and help develop financial education programs. The goal is to provide simple investment insights.

Starting in January, ENGIE will offer dedicated training modules to its women shareholders, with the option of inviting a friend to attend the webinar for free. The idea is to encourage women to invest and take their rightful place in the real economy.

For ENGIE, the goal is to have a shareholder base that more closely reflects civil society—shareholders who are engaged and express themselves, for example by voting on resolutions at the Annual General Meeting.

Why and how is ENGIE committed to financial education?

Understanding investment mechanisms is essential to build wealth, prepare for retirement, or finance projects. Managing one’s budget, deciding to invest, and getting started require some knowledge. ENGIE supports initiatives related to financial education, especially initiatives that help better understand stock market investing.

Concretely, the Group has launched the following actions:

- Support for the Investisseurs Academy training platform, free and accessible to all

- For women: a 2×45-minute training webinar on savings, investment, and the stock market, available in early 2026, and a mentoring program

- Themed videos and brochures, for example on transferring shares

- Co-development or participation in podcasts such as Perspectives de Vie by Célia Rabic, or the Investor Summit attended by Jean-Pierre Clamadieu, Chairman of ENGIE’s Board of Directors

This is also a way to strengthen the dialogue between ENGIE and civil society. The Group’s retail shareholders are often long-term investors, less reactive to market fluctuations. They take a citizen-driven perspective on the company, vote at the Annual General Meeting, and make requests in addition to those of institutional investors.

|

|